Tax Structure of GST, Goods and Service Tax Taxation Structure

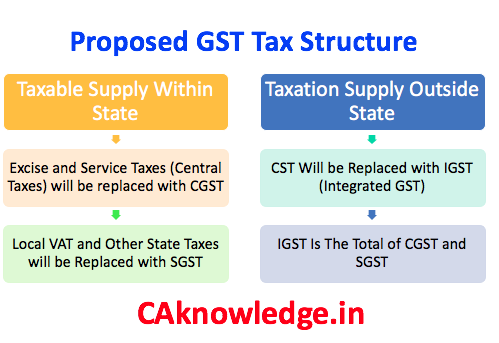

CGST – Central Goods and Service TaxSGST – State Goods and Service TaxIGST – Integrated Goods and Service Tax/ (CGST+SGST)

Additional Tax (upto 1%) to be levied in case of inter-state supply of goods, which is a non-vatable item. Hence, no input credit available on such.

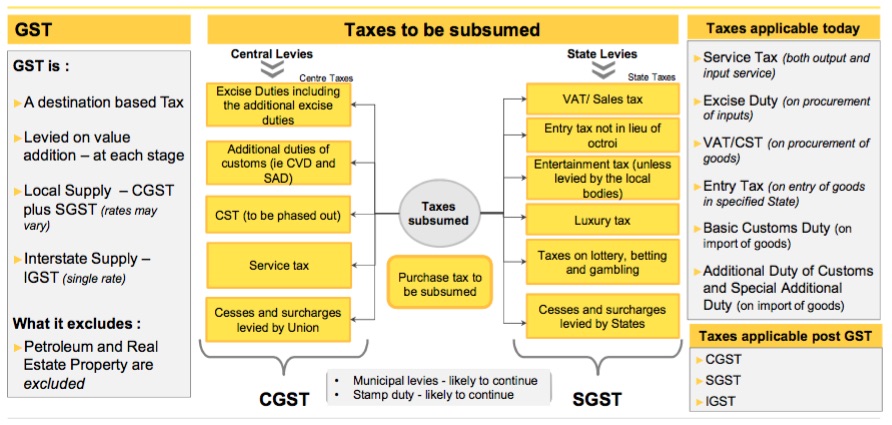

Taxes to be subsumed under GST Structure:

Post implementation, the following Central and State indirect taxes would be subsumed in GST and existing indirect taxes takes the form of CGST, SGST and IGST as per above proposed model.

Central taxes to be subsumed in GST

Central Excise DutyAdditional Excise Duties,Excise Duty levied under the Medicinal and Toilet Preparations (Excise Duties) Act 1955Service Tax,Additional Customs Duty (Countervailing Duty)Special Additional Duty of Customs – 4% (SAD),Central Surcharges and Cesses in the nature of taxes on goods/services like cess on rubber, tea, coffee, national calamity contingent duty etc

State taxes to be subsumed in GST

State VAT/Sales Tax,Entertainment tax (unless it is levied by the local bodies),Luxury Tax,Taxes on lottery, Betting and gambling.Tax on advertisements,State Cesses and Surcharges in the nature of taxes on goods/ servicesOctroi and Entry TaxPurchase tax

Some of the taxes that would be continued under GST regime are Basic customs duty, property tax, stamp duty, vehicle tax etc. Alcoholic liquor for human consumption is exempted from the purview of GST and tobacco products would be subject to separate excise duty in addition to GST. Further, the petroleum products would be continued to be taxed as per the existing laws and would be transitioned into GST regime from a future date to be notified by the GST Council.

Conclusion

The GST has the potential to push India’s GDP by 1% -2% and as rightly pronounced in Economic Survey 2015-16, GST “is a reform perhaps unprecedented in modern global tax history”. With the implementation of GST, the taxpayers will breathe a sigh of relief as they are likely to get free from the requirement of multiple compliances under various states, as the proposed GST regime provides for a single registration and a single return. Further, it provides major impetus to MAKE IN INDIA initiative of Government of India by attracting new foreign investments and by reducing manufacturing cost in the form of reduced compliance cost and taxes Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply