Opportunities for CAs under GST Regime, Role of CA in GST

What an Industry is looking from CA

GST Overview to Client in relation to Client IndustryAssessment of Current impact of Excise Duty, VAT, Service Tax, Customs, Octroi etc. in relation to businessBusiness Requirement Document – with Transaction mapping along with Process re-alignment MatrixCategorization of Revenue stream of the Company along with Stock TransfersOperational and Working Capital Impact Analysis along with Taxable GainPossible modification sin IT SystemTraining and Compliance Calendar

GST Overview

GST is a Comprehensive Indirect Tax across IndiaGST regime has no distinction between Goods and Service.The Tax will be levied at point of Supply, which will impact timingDual Control established. Tax Payer < 1.50 Crore Turnover be assessed by State and rest by Center.While Inter-State transaction attract IGST, and rest SGST + CGST. Gross Utilisation of Credits is protected.GST Registration may be required in each state of operation, which was the case for Goods Industry but not for Service.Full Chain of transaction from Manufacturer to dealer to retailer to consumer is transparent for the first time.Multiple GST Rates for different Category of Products and Services to protect lively hood of masses while collecting enough Tax.States are compensated for any loss in first 5 years. Which allows them to continue Sales tax Incentives [ PSI ] for development of Industry.Output Tax in most cases will be equal or higher as few Tax rates such as 0%, 5%, 12%, 28%, 28% are fixed.

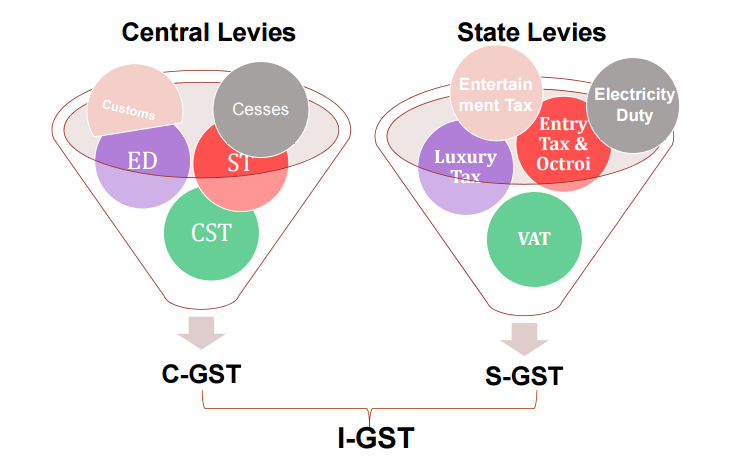

GST Overview – Taxes to be subsumed

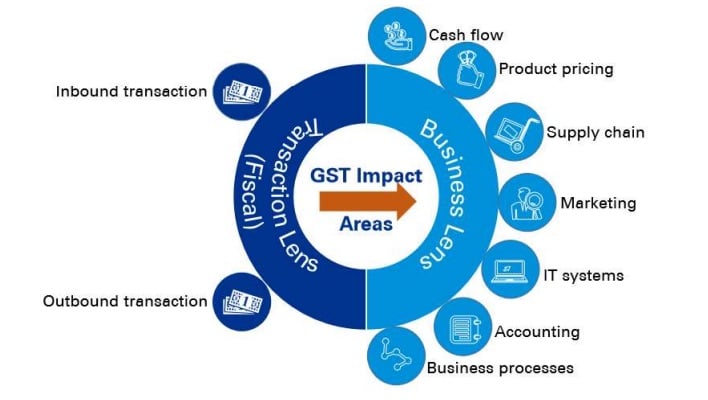

GST Overview – Key Impact areas

There is a need to look at impact areas from a twin perspective of transactions and business model

Assessment of Current Tax Losses

Excise Duty – Companies that sell Products which are Non-Excisable is not Duty able to take credit of Excise on goods procured VAT – Companies that sell Services is not able to take credit of VAT on goods procured Service Tax – Companies that sell Goods is not able to take credit of Service Tax on Services procured Octroi – Companies that sell Goods is specified cities are not able to take credit of Octroi / LBT / Entry Tax. CST – Companies that buy goods from inter-state are unable to take credit of Central Sales Tax. CAs can help Organisation to assess the Credits lost from above Taxes.

As these costs are not separately booked in financial records but are added to respective expenditure, active expenditure, this requires transactional review to assess the value of credit loss.Generally this amount is relatively large and excites the Management of the Company and CAs can capitalize on their value addition.

Business Alignment – Procurement

Supplier Selection – Supplier selection needs to be done carefully

Procurement of goods and service need to be balanced with Output GST in terms of IGST and SGST+CGSTSuppliers Taxes will change and benefit needs to be negotiated.

Supplier Compliances – Companies that sell Goods is specified cities are not able to take credit of Octroi / LBT / Entry Tax.

Supplier registration in GST is a pre-condition for Input taxSupplier filing of Tax returns is must

Invoicing Formats need to meet the needs of Input Credit. CAs can help Companies by devising the proper matrix of purchase and compliances

Purchases in the state in which there is no sale may have risks of loss input creditDirect Payment to suppliers rather than reimbursement to Employees may be beneficial.Cross Credits between SGST and CGST may not be possible.

Business Alignment – Movement of Goods

Depot / Branch Office – Need for a Depot must be re-evaluated carefully

Every movement of Goods is an incidence of Tax. I.E., transfer of goods from Factory to it’s own Warehouse is subject to GST.Stock levels in Depots need to be re-examined to avoid excess stock coming back to Factory.Stocks expiring in Depots without sale is also subject to GST.Multiple Legal Entities and sale from one to another may need to re-looked.Valuation of Goods for the purpose of GST in case on inter-branch transfer is tricky and can exceed sale value ultimately if not planned well.

Dealers and Wholesalers – Dealers need to have full compliance and recording.

Dealers must be registered in GST subject to minimum threshold of Rs. 20 Lakhs and 10 Lakhs as the case may be.Dealers need to file GST compliance Returns to ensure proper credit of Inputs.All Sales shall be mapped not only by GST Rates but also by HSN Category and Supplier wise

CAs can help

Draft a proper SOPRe-designing the need for Depots / warehouse to optimize business need and tax managementDealers may need help in accounting set-up and standardizing the information flowDealers margin may get impacted and there may be a need for making RoI model for dealers.

Categorisation of Revenue Stream

Categorisation of Sales based on GST Rates – Categorisation of Sales based on GST Rates

Input Credit is allowed only if there is Output Credit for that business stream.Assessment of 100% eligibility of Credit, 100% non-eligibility and partial eligibility to assess the MRP at which to sale.Some products may make higher Margin and some may make lower as a result of this change and therefore price revision may be warranted.Valuation of Goods for Inter-Branch transfer shall be computed.

Forms / Way Bills – Sales will be impacted by Forms and Way Bills

Existing process of F-Forms, C-Forms etc no longer validA new system of electronic Way Bills is introduced, where every movement of Goods in excess of Rs. 50,000 require a Way Bill.Invoicing Formats need to be redefined to provide all essential information for filing of Tax returns.

CAs can help

Draft a proper SOPDeploying a Matrix of eligibility of Input vs. Output.Re-Validating Margins by Products and Tax Category to assess where to take price increase / reductionDeveloping formats of Invoicing

Operational / Working Capital

Operation al Efficiency – Need to assess opportunities in Operations

For a Company transporting Goods form state to states have been facing a significant challenge of State Borders, with one single Tax, these borders will be flawless.A proper E-Way Bill system is key to drive operational efficiency

Working Capital – Working Capital needs to be re-assessed

As the movement of goods between branches will attract GST, there is a need for higher Working capitalThe Tax structure of Consignment Agents may see significant change. Transfer of goods to Super Stockiest may not be a new business model.There is likely to be higher Input Credits lying in B/S due to time gaps.

CAs can help

Evaluate the value of Operational Efficiency to become more competitive.Negotiate with Transporters as they may have different economics of transactions going forward.

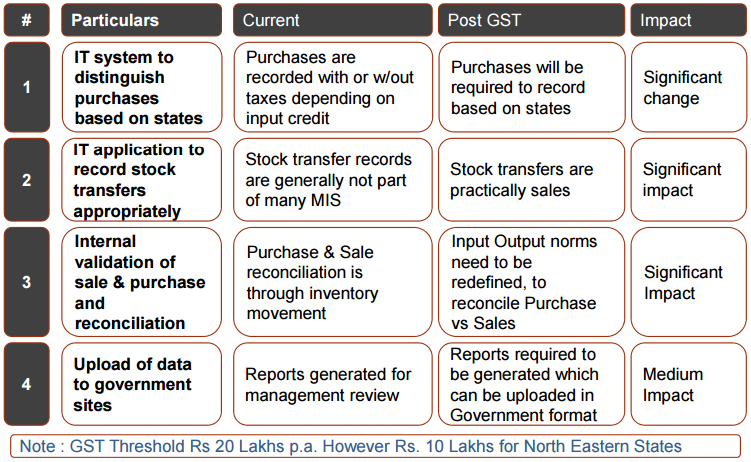

Impact of GST on IT Applications

Impact on IT Systems

GST is likely to impact several aspects of IT systems Changes in the systems are likely to be required primarily on the following:

Change in Taxes / Tax ratesAvailability of credits for input taxes on purchases including inter-state purchases and import GST, and also the order / sequence of set-offAvailability of cross credits for goods and servicesGST on Stock-transfers

Broadly, the changes required in IT system on account of GST can be categorized into the following:

Need for addition/modification/omission of certain data fieldsChanges in the in-built logic for computation of some data fields

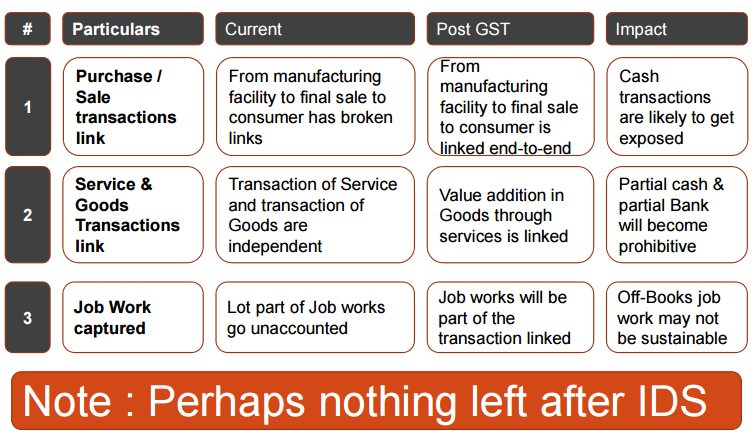

Impact of GST on Cash Transactions

Impact of GST on Compliance

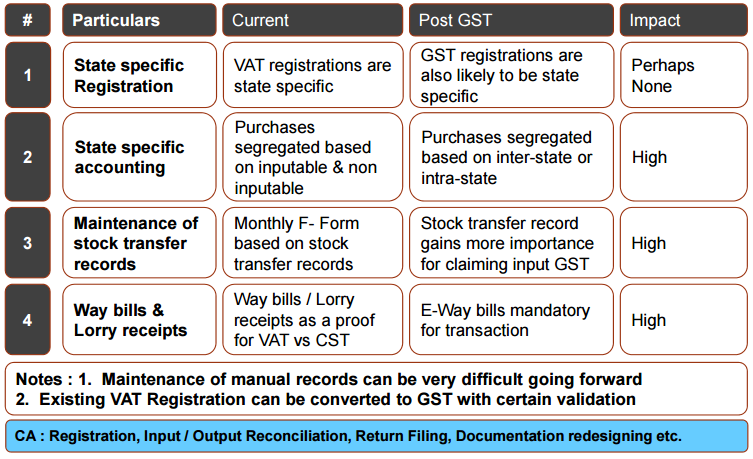

Impact of GST on Accounting

Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply